Life includes both financial ups and downs. With rising inflation all over the world, everyone is facing a hard time managing their finances. But, if you are facing a hard time, you do not need to worry. There is now every possible solution to every problem and we can make our work much easier using different tools.

There was a time when a person had to spend his whole day applying for a loan at a nearby bank and transferring the loan amount into a bank account further took a few days. But now, online available tools have overcome this major problem and now we can apply for every kind of loan just by sitting at home.

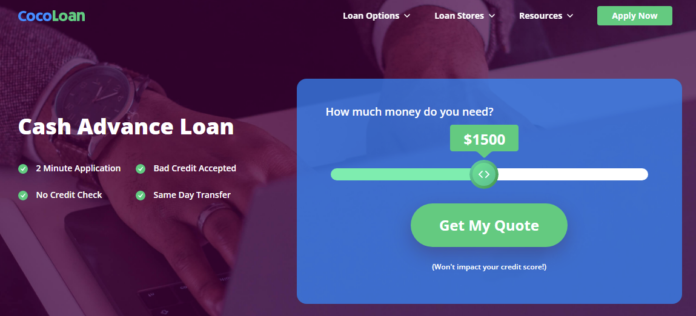

Today, we are going to introduce you with cash advance loans that will help you overcome your short-term expenses which may include car expenses, medical bills, etc. Moreover, you will also be introduced to the efficient loan broker, CocoLoan from where you can easily cash advance loans quickly.

What Are The Types Of Cash Advance Loans?

Cash Advances help you immensely and their terms and conditions are very simple. They vary from lender to lender. Some of the different types of Cash advances are listed below:

- Merchant Cash Advance

This type of advance money does not require collateral. This is based on the advance money you get in exchange for a portion of the receivables of the credit card of your future business. This is given to a business model and is greatly dependent on its profits.

The MCA will pay you money based on your sales volume. But this is safe and is not risky at all. If you are financially in a tight situation, this is the best solution.

- Payday Loans

Payday loans give you loans by taking your paycheck as collateral. Their service is super fast. Through payday loans, you can get your loan within a day. The application process is simple and fast.

Through payday loans, you apply, after that, the lenders contact you and sign an agreement, and boom after a few hours you got money in your account. This is very helpful in emergencies.

Steps To Get Cash Advance Loans Through CocoLoan

Getting a cash advance loan is very easy and this process has become more trouble-free because of CocoLoan, a recommended loan broker. Sarah Ross, Co-founder of CocoLoan, says you can take a look at cash advance from direct lender at this webpage.

Step 1: Apply

Open the official website of CocoLoan and then complete the application form available on the main page.

Step 2: Review

The form will be transferred to the network of lenders who will review your data and send you their offers. After selecting a particular offer, it’s time to sign the agreement.

Step 3: Get the Amount

Once, the lender and you are satisfied with the agreement, the loan amount will be shifted to your bank account.

Benefits And Drawbacks Of Cash Advance Loans

The benefits and drawbacks practiced by cash advance loans are mentioned below:

Pros

- One of its most significant benefits is that it is available to everyone who has a credit card without any exceptions.

- Its service is very fast. You do not have to wait for months to get your money which happens through traditional methods. You can get your money the next day of your application for a loan through this process.

- As we previously said that it does not consider credit history. You can get money as a loan based on your credit card limit. Your credit history must not be excellent to qualify.

- It is a very convenient, non-conventional method of getting money. If you went out to purchase something and you are out of cash, you can easily withdraw money from an automated teller Machine(ATM).

- Is it not amazing? No need to go through the hassle of the application process every single time you need money. You can easily withdraw money through an ATM.

- The money you get depends on your own needs. You may get a large money sum or a very small sum. It all depends on your expenditures. So it is a very flexible and consumer-friendly way. The services are truly in favor of consumers.

Cons

- Its biggest disadvantage is that the advance fee is quite large. The fee will be minus whenever the withdrawal of money takes place.

- It does not improve your credit card score, as it is not reported to the consumer Credit bureau.

These are a few disadvantages, otherwise, it’s a very beneficial and fast service through which you can borrow money in case of any economic difficulty.

Two Ways Of Apply Online For Cash Advance Loans

Now, let us know some simple ways of finding cash advance loans from where you can borrow money within 24 hours of applying.

- Direct lender

A direct lender may be able to help you out financially in an emergency. Therefore all you have to do to obtain it is speak with the lender. For that, you have to fill out an application, and submit it. The lenders will review your provided data and try to contact you with the best terms and conditions possible.

After accepting the terms you sign an agreement with the lender and he immediately transfers money to your account by the end of the day.

- Brokers

Another way of getting money is to get it through professional brokers. There are many specialized brokers in the industry. The thing that you just have to do is to approach them. There are many different online forums through which you can access them.

You just have to complete an application form and provide them with all the necessary information. They will review your information and will contact the most trusted lenders. They act as a bridge between

Ending Remarks

Getting a cash advance loan is itself now a hard task but only if you are aware of the way to find them and you have access to a reliable loan broker. If you are thinking of getting a cash advance loan.